rsu tax rate uk

The loss from the sale of shares can be carried forward up to 5 years. On the restriction lifting the share is now worth 200.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

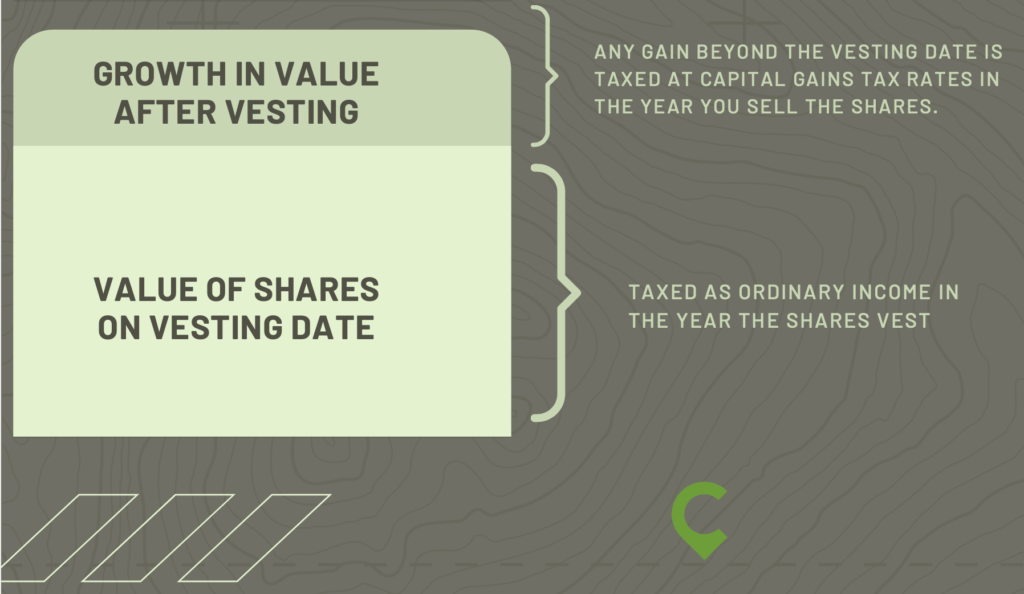

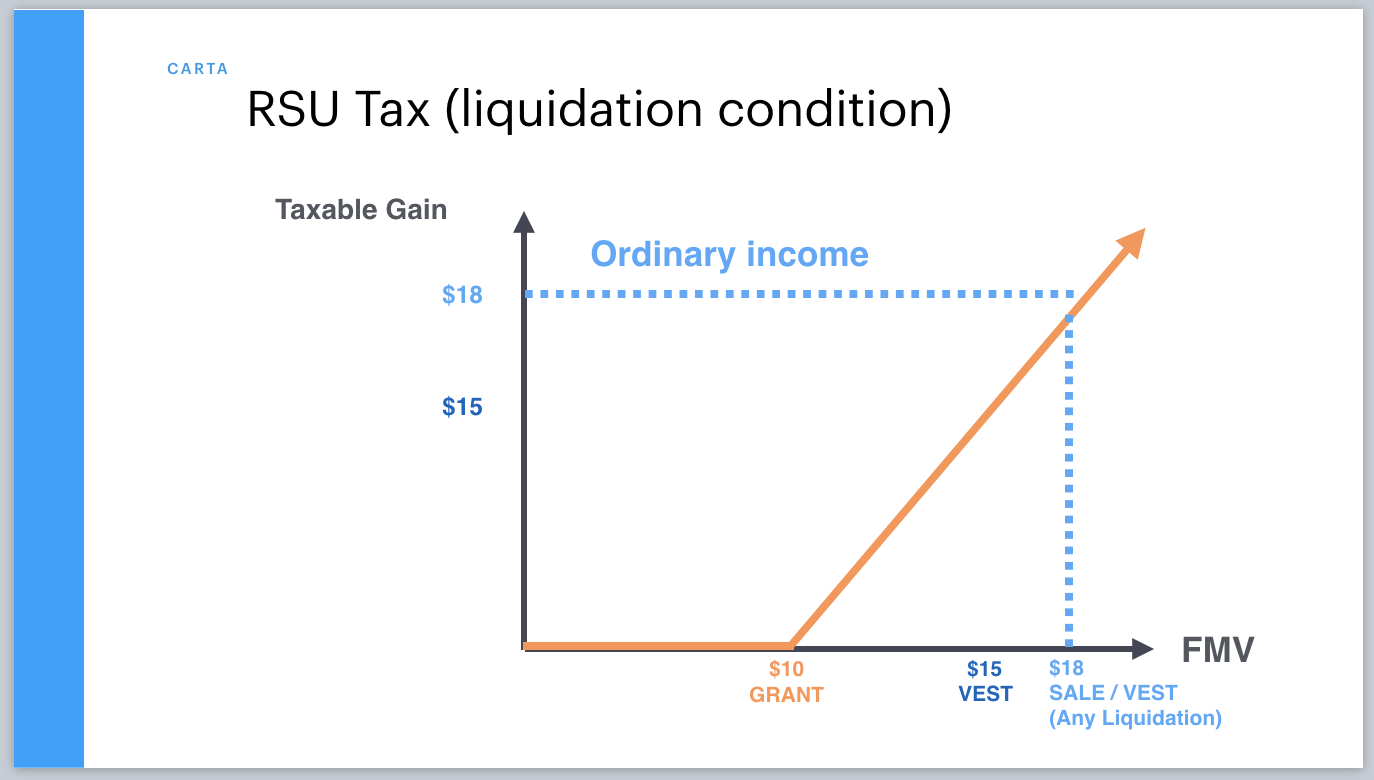

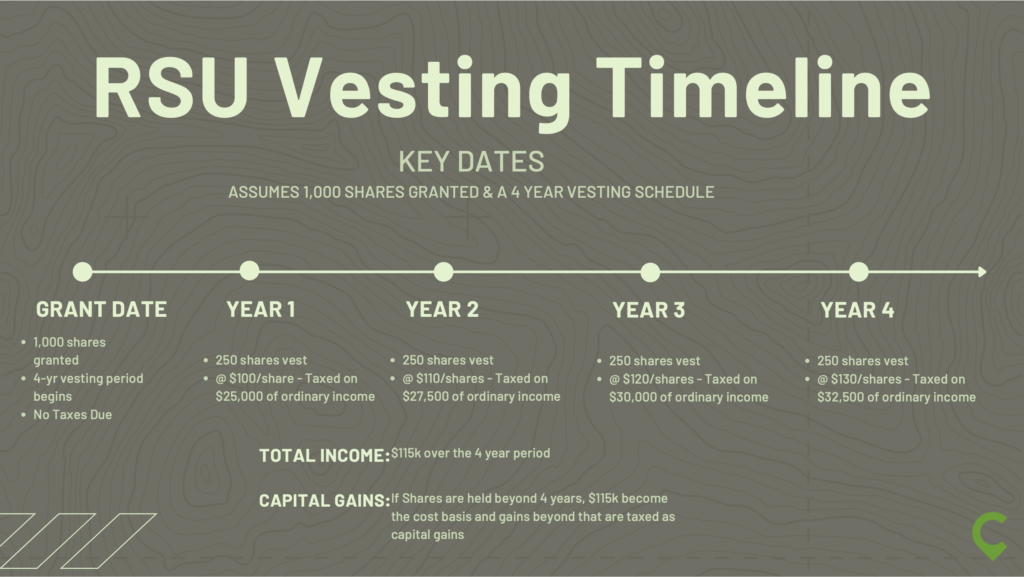

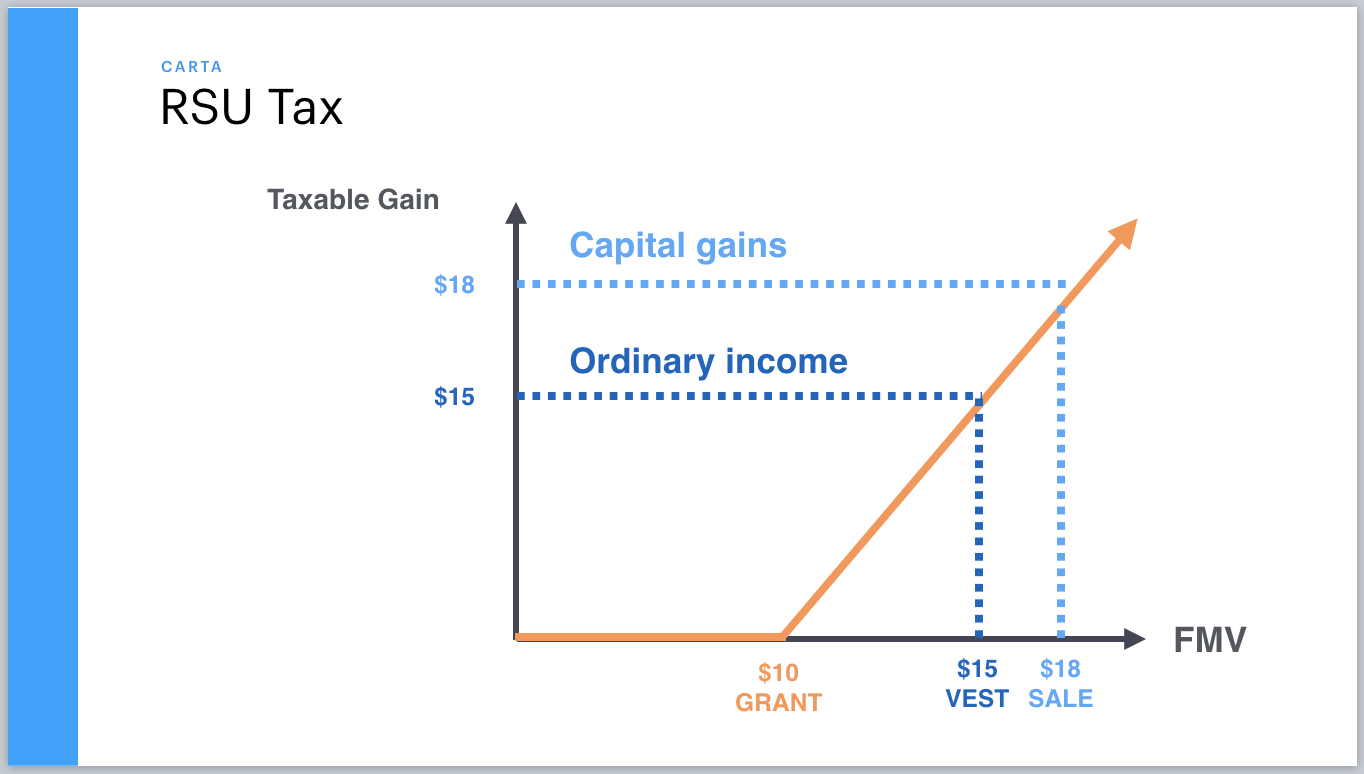

RSUs can also be subject to capital.

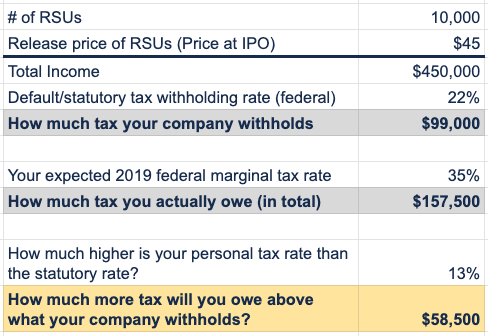

. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance. From there the RSU projection tool will model the total economic value of your grant over the years. Please note that if your RSU income is taxed above 22 when your taxes are filed depending on your other tax withholdings you.

Total Tax and NIC 10000. For your state tax rate itd be a little much for us to pull each states income tax and include it. So its up to you to enter a percentage.

Extra tax of 4310 due to loss of personal allowance as income above 100000 employee nic 2 431. Less National Insurance 2-345. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

At this point the employee is charged to income tax on 30. The stock is restricted because it is subject to certain conditions. Salary 100000 RSU Value 25000.

If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. Owners of a 200000 home would see about a 12 tax increase under Baths proposed 2023 budget which the city council will.

For every 2 you earn above 100000 your Personal Allowance is reduced by 1. Here is the information you need to know prior to jumping in. A big note here you must enter a value even if the value is 0.

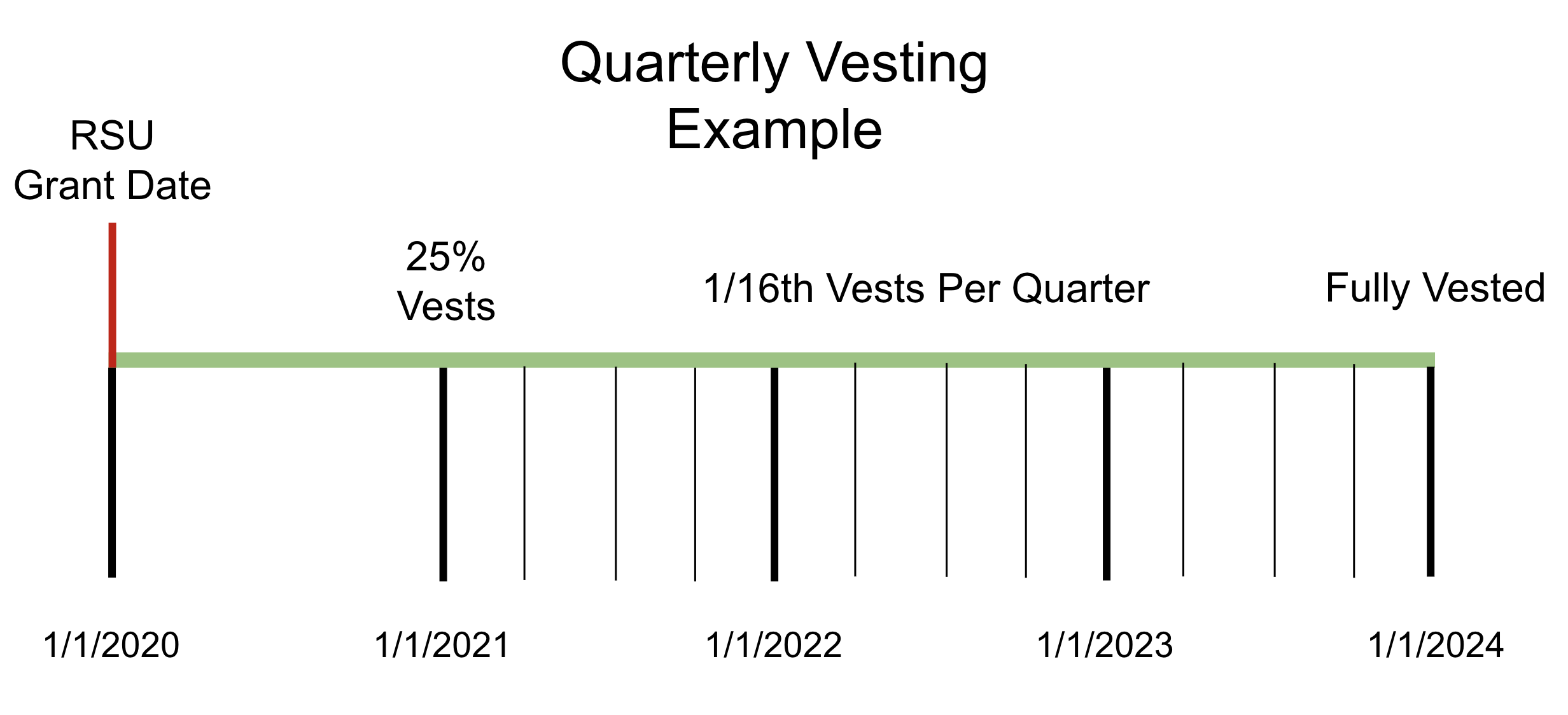

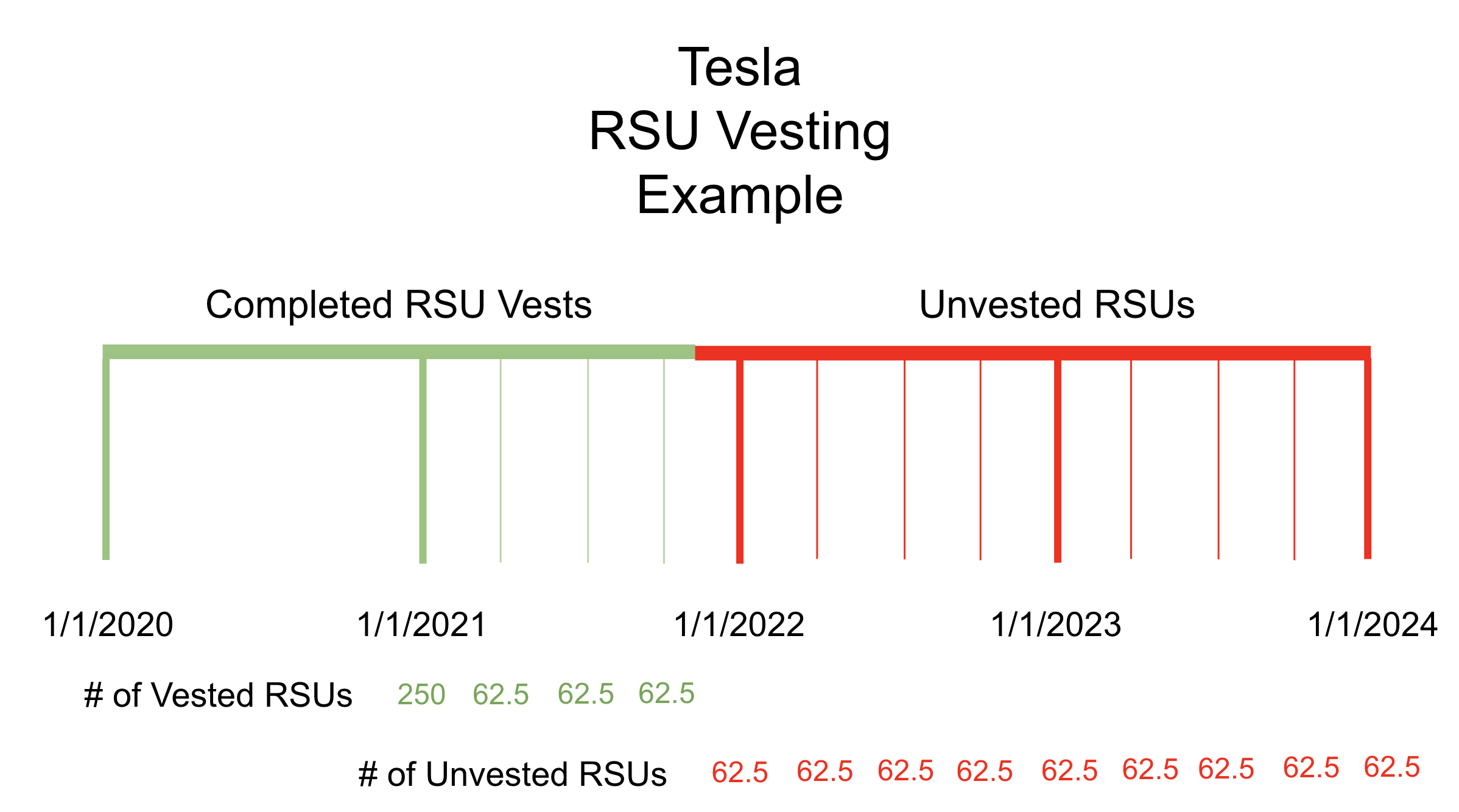

Less 40 Income Tax 40 Higher Rate Tax no lost personal allowance-6896. Residual Value After All Tax. This happens over time through a vesting schedule.

This is known as the 60 tax trap. Extra tax of 4310 due to loss of personal allowance as income above 100000. Restricted Stock Units RSUs Tax Calculator.

To help us improve GOVUK wed like to know more about your visit today. Taxation of RSUs. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate.

Here is an article on employee stock options. You will be taxed on the difference between the sale proceeds and the fair market value of the shares at vesting. Because the RSUs pushes your total income above 100000 you will pay 60 income tax on the RSUs.

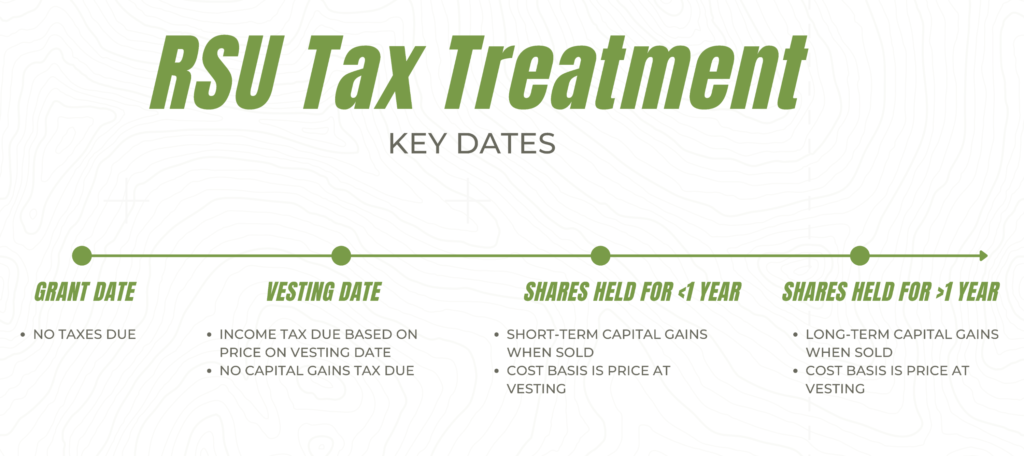

How Are Restricted Stock Units RSUs Taxed. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Net RSU Value Before Employer Income Tax NI.

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance.

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would. Income tax 40 of Remaining 8620.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Acquiring RSUs RSUs are not taxable when they are granted. Its is a considerable sum especially as it was taxed at 45 plus NI while I presently have only a minimal income and no NI to pay though this is income so will likely be lifting to pay NI.

There are various occasions when RSUs may attract taxes in the UK when owned by someone who is UK tax resident and reporting the taxation which is not handled by the employer can be a minefield especially if shares have been held for a while before being sold. Most companies will withhold federal income taxes at a flat rate of 22. Step 4 - Edit State Tax Rate Assumption.

You will be subject to capital gains tax at a flat rate of currently 18 when you subsequently sell any shares acquired at vesting of the restricted stock units at a gain. Deducting employers NIC 138 3450. Employee total salary before RSU is 100000.

Well send you a link to a feedback form. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift.

Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. Plus Basic Rate tax relief on pension contribution. Net pay 10000.

Restricted stock is a stock typically given to an executive of a company. If the rsus take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers national insurance. At any rate RSUs are seen as supplemental income.

For 2021 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million. If the employee received the RSU for free the employment tax charge would be 80. Through the scheme a proportion of those RSUs have already been sold to cover my taxation liabilitywithholding tax.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. Because there is no actual stock issued at grant no Section 83 b election is permitted.

The value of over 1 million will be taxed at 37. 9 hours agoBath officials project modest tax increases in proposed 2023 budget. RSUs usually have taxes withheld from their incomeSince RSUs are considered supplemental income under Internal Revenue Code s Code their withholding rates differ substantially from 22 to 37 depending on whether you receive them as part of.

Will determine the correct tax treatment. Restricted stock units RSU. 50 Tax and NIC paid.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

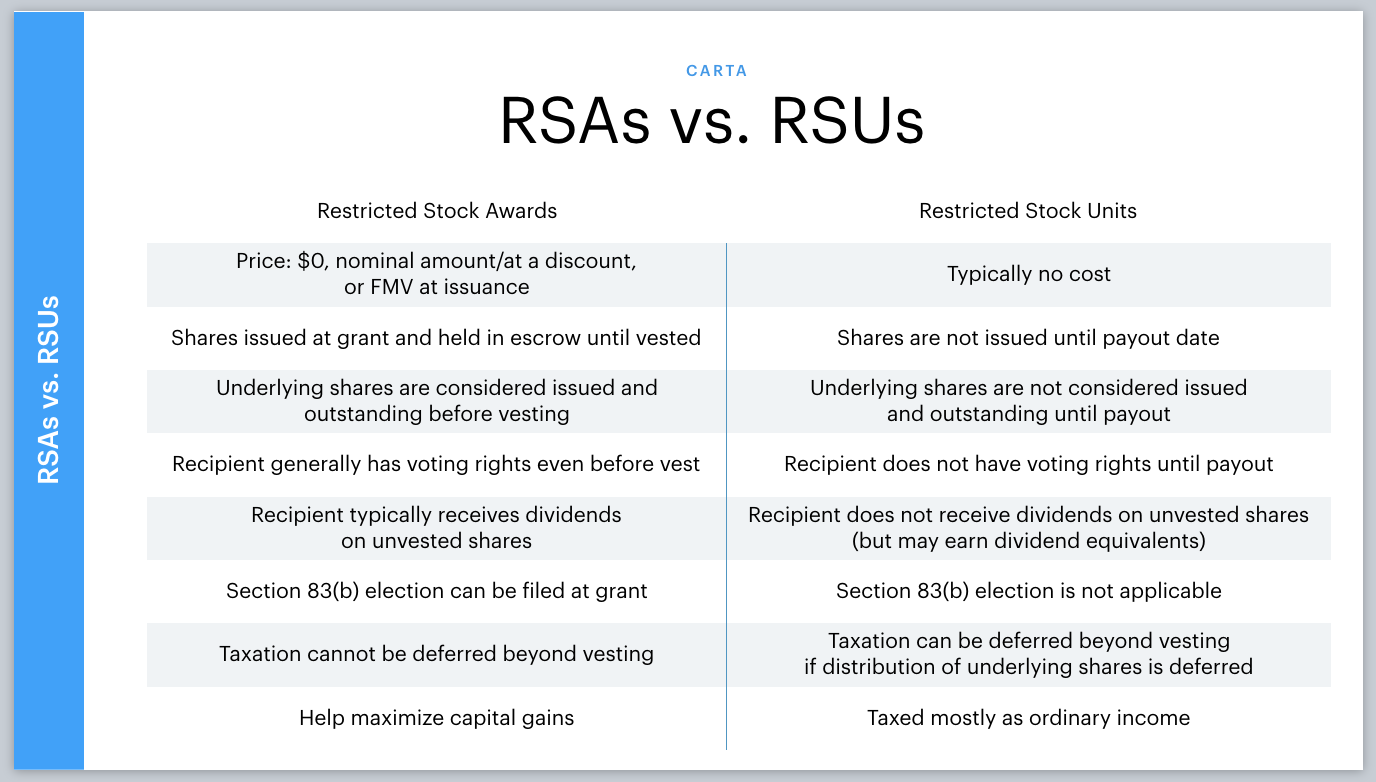

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

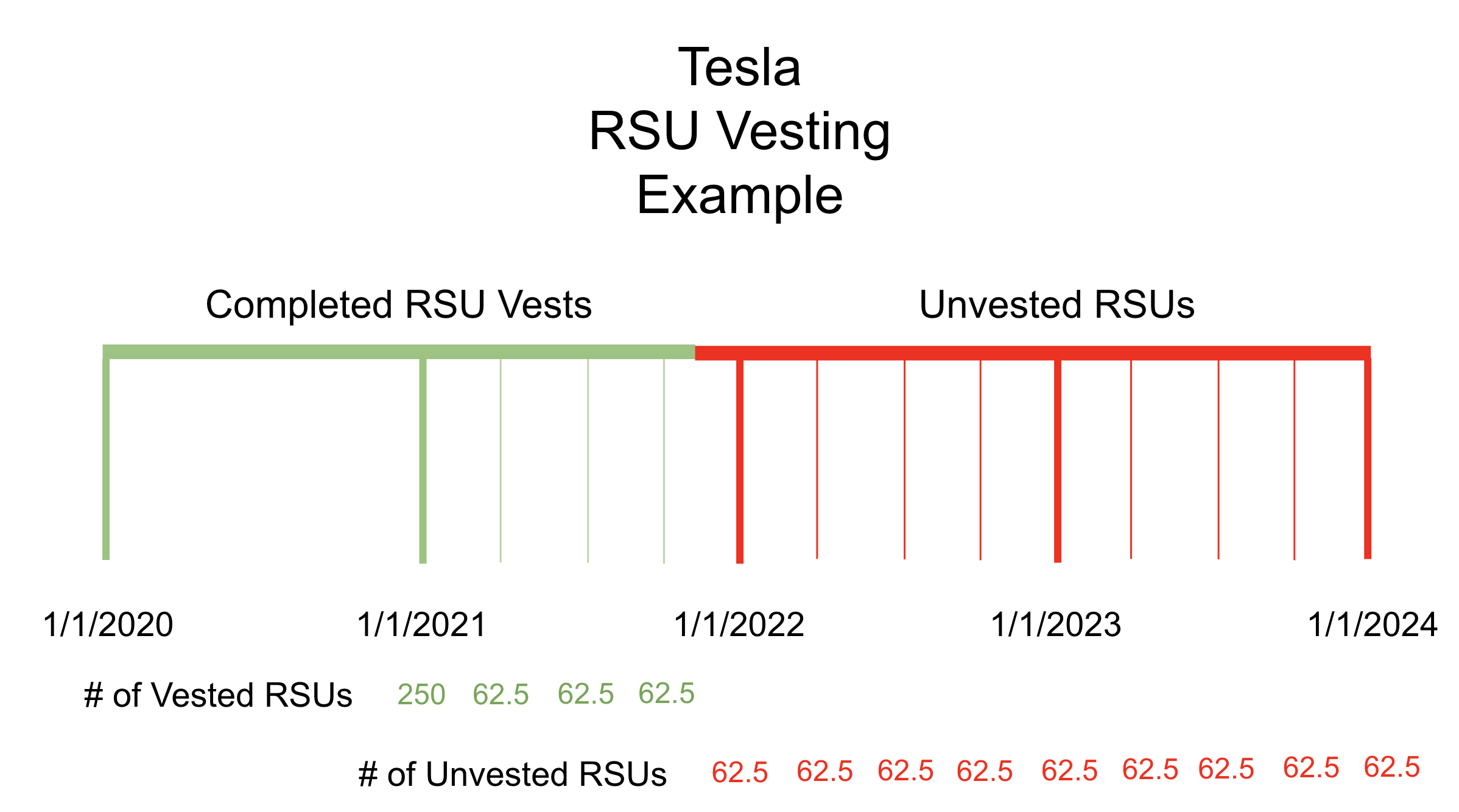

What Happens To Rsus When You Quit Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

A Tech Employee S Guide To Rsus Cordant Wealth Partners

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

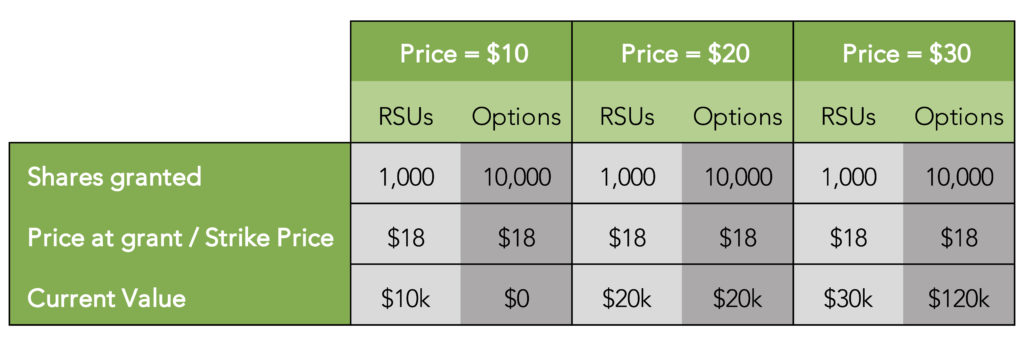

Stock Options Vs Rsus What S The Difference Thestreet

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021