stock option tax calculator canada

Poor Mans Covered Call calculator addedPMCC Calculator. Get better visibility to your tax bracket marginal tax rate.

When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by.

. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Considering certain conditions are met you can claim a deduction.

Locate current stock prices by entering the ticker symbol. Lets say you got a grant price of 20 per share but when you exercise your. Find a Dedicated Financial Advisor Now.

Open an Account Now. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. For example the option price is 10 for 15.

The Stock Option Plan specifies the total number of shares in the option pool. Exercising your non-qualified stock options triggers a tax. Open an Account Now.

The calculator will show your tax savings when you vary your. Even after a few years of moderate growth stock options can produce a. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

Cash Secured Put calculator addedCSP Calculator. Find A Dedicated Financial Advisor. Please enter your option information below to see your potential savings.

Find the best spreads and short options Our Option Finder tool. 2021 free Canada income tax calculator to quickly estimate your provincial taxes. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Poor mans covered call calculator addedpmcc calculator. The stock options were granted pursuant to an official employer Stock Option Plan. When you exercise your employee stock options a taxable benefit will be calculated.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. Option grants that do not qualify for stock option.

This benefit should be reported on the T4 slip issued by your employer. Stock option tax calculator canada. You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you.

The Stock Option Plan. This calculator illustrates the tax benefits of exercising your stock options before IPO. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. You will only need to pay the greater of. If the exercise price of the option is fixed at an amount that is not less.

2021 Income Tax Calculator Canada. The taxable benefit is the difference. Deduct CPP contributions and income tax.

Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. Under the employee stock option. Taxes for Non-Qualified Stock Options.

Life Is For Living. Option grants that qualify for stock option deduction. Stock option plan This plan allows the employee to purchase shares of the employers company or of a non-arms length company at a pre-determined price.

Taxable benefit When a. Lets Partner Through All Of It. Gain access to the Nasdaq-100 Index at 1100th the notional value.

This permalink creates a unique url for this online calculator with your saved information. Click to follow the link and save it to your Favorites so. This easy to use online alternative minimum tax AMT calculator estimates your tax liability after exercising Incentive Stock Options ISO for 2022.

How much are your stock options worth. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Do Your Investments Align with Your Goals.

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Transfer

Derivative Investment One Of The Best Alternative Investments Option Financial Asset Related Contract Betwe Derivatives Market Tax Deductions Online Trading

Understanding 1 10 Net 30 Investing Mortgage Payoff Stock Market

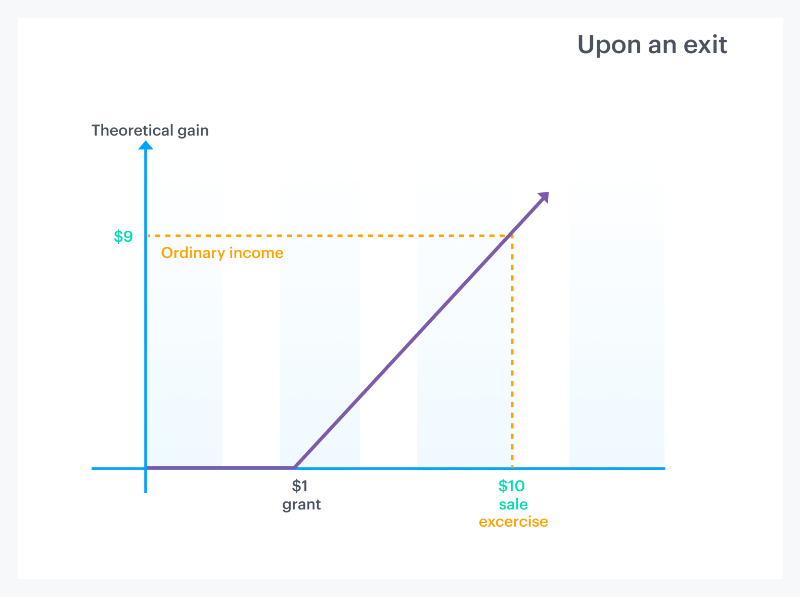

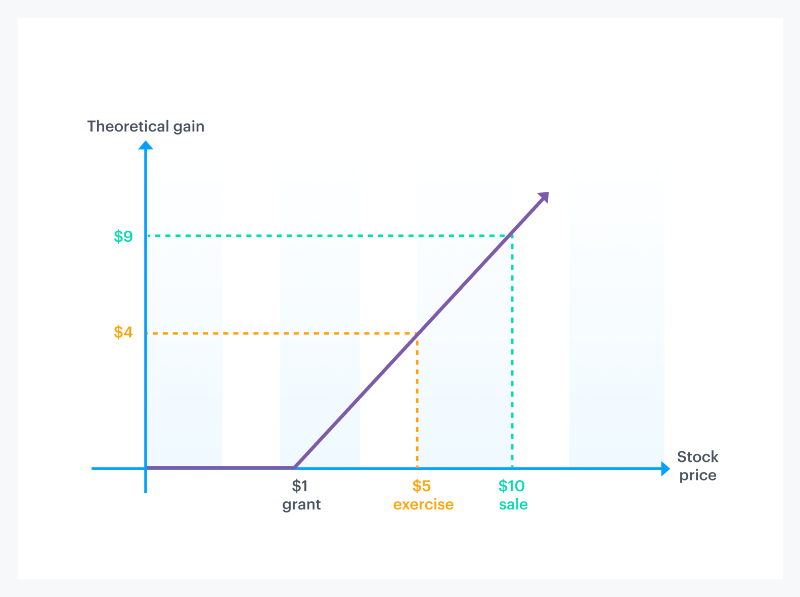

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

Mustache Calculator To Plan For Your Financial Independence Financial Independence How To Plan Independence

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Income Property

Option Price Calculator American Or European Options

Pin On Retirement Eol Planning Rving

Annuity Calculator For Excel Annuity Calculator Annuity Savings Calculator

Tfsa Investors 2 Best Dividend Stocks For The Next Decade The Motley Fool Canada Payday Loans Loans For Bad Credit Debt Consolidation Loans

Minimum Credit Score Required To Get A Mortgage In Canada Canada Wide Financial Mortgage Loans Credit Score Mortgage Payment

How To Trade Stock Options For Beginners Stock Options Trading Option Trading Stock Options

Tickers To Follow Video Aug 03 2021 Day Trading Value Stocks Stock Trading

Taxtips Ca Cpp Retirement Pension Calculator Information Page Retirement Pension Calculator Retirement

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen